12 Things property development lenders look for when funding projects

If you’re a property developer who is looking for funding to help get your next project off the ground, it’s important to know what lenders are looking for before they decide to invest.

In this blog post, we will outline 12 things that property development lenders typically look for before funding a property development project. Keep these in mind as you move forward with your own development plans!

Almost every experienced property development lender has heard of the five Cs of credit, that are character, capacity, cash flow, capital, and collateral.

These are reminders to ensure that all requirements for underwriting a loan request are met.

When a lender concentrates solely on the deal’s structure—cash flow, capital, and collateral—rather than the borrower’s capacity and character, he makes an incredibly common (and often fatal) mistake.

Capacity and character are especially vital in any commercial and residential property development, where the borrower’s and his team’s performance is critical. However, lenders always prefer determining who the borrower is.

What is the borrower’s legal entity?

You’ve been introduced to the various types of legal ownership if you’ve attended an introductory law course, a property development course, or a broker course.

A limited partnership (LP) and a limited liability company (LLC) are the most common ownership structures in commercial real estate.

The restricted liability these two types afford investors is one of the main reasons for their use.

In an LLC, each member is alone responsible for their investment. The same is true with a limited partnership, except for the general partner, usually the developer.

Another significant benefit is that investors avoid paying double distributions (dividends) tax. Profits (and losses) from partnerships and LLCs are “passed through” to individual investors.

They aren’t taxed twice: once at the corporate/partnership level and again at the individual level. Profits and losses from LPs and LLCs may move through numerous legal entities before being recognized by each partner or member.

Single purpose entity in real estate

The legal entity that owns the property is always a single-purpose business to avoid commingling funds to other projects, identify diverse capital compositions among investors, eliminate tax concerns from other initiatives, and aid in organizing and bookkeeping.

That is, it will be made specifically for your borrowing purpose. It’s critical to understand the primary players behind the ownership entity and, more importantly, who will be in charge of it during the loan period.

Who is in charge?

The developer prepares the property development loan proposal. He is the primary player in analysis because he is anticipated to be in charge of the project.

The developer has ultimate power and responsibility for the borrowing entity’s whole operation. He will carry out all the duties necessary to complete the project, pay off the loan, and allow the investors to profit.

What is owned by whom?

An LLC’s operating agreement is an excellent place to figure out who the members of an owning entity are and what rights they have (or a partnership agreement or a similar document).

This document will spell out the parties’ legal ownership interests, as well as their responsibilities and rights.

The fewer persons involved in any organization that may be relied upon to reach an agreement, the better. It would be best if the lender inquired about the members of the team and what the developer expects of them throughout the project’s lifespan.

It is crucial for the PD lenders to find out who owns the legal entities that are members of the ownership entity and how they will be participating. Then they figure out how each member’s risk-reward connection works.

Risk and rewards in real estate

Owners’ risk-reward connections frequently do not reflect their monetary inputs.

The “money member,” for example, might provide 90% of the minimum stock in exchange for a deferred simple 10% interest rate and a 50% share of the expected profits.

For the remaining 50% of profits, the developer may contribute 10% of the stock (it is unusual but not extraordinary for a developer to contribute no cash equity at all).

In this case, the money member is putting his money on the line. However, his risk is lessened by the fact that he will get 10% simple interest (referred to as a “pref”) before his equity is returned.

The equity might be returned to him first or split proportionally (sometimes referred to as a pari passu basis).

In this case, he would receive 90 cents for every dollar of stock returned on a pari passu basis. If the project does not make a profit as predicted, he may still be able to recoup his entire investment plus a ten per cent annual return in the form of deferred interest.

The developer will receive his 10% share back either on a pari passu basis or when the money member receives his entire equity back.

The developer does not receive any rewards for his work until all equity has been repaid to investors or lenders.

However, because the developer may be paid a developer fee, a general contractor fee, a profit fee, an overhead fee, or a construction manager fee directly or indirectly through affiliates or relationships, he may be able to make a good profit and recoup his equity investment regardless of whether the planned project makes or even loses money.

In this case, the developer may not be interested in seeing the project through to completion because he has already received his 10% ownership plus some additional income from fees. On the other hand, the partner may suffer a significant loss.

Alternatively, a developer may choose to remain participating in a project to continue receiving fees, mainly if they are significant compared to his net worth.

Learn More

Additional funding

When reviewing the partnership agreement or the operating agreement, pay attention to the capital call provision, which specifies who pays if more money is needed.

Even if the project’s prognosis indicates a positive return, there may be a funding shortage along the route to completion.

Additional equity capital is frequently available if profits are expected. However, regardless of how solid the estimates are, the property development lender may face a problem loan if the investors cannot come up with extra funds.

When a property development lender can acquire a sense of what is at stake for each member and partner, it can help reduce an undesirable circumstance created by a developer’s lack of finances.

Money is more likely to be found when and if needed when there is a lot on the line. Subjectivity and intuition can significantly affect how the property development loan is structured and how much it costs.

Learn More

Actual working relationship vs. Legal relationship

Even if the property developer has a formal definition of responsibilities, there are situations when he may not have as much control as he appears to have.

When a well-known, experienced, or powerful money partner is involved in the agreement, this is more likely to be the case.

Because he relies on the more vital partner, the developer, the weaker financial partner, may be severely limited.

He may even be so reliant that he cannot make a living or continue his growth activities without a more vital partner.

If there are issues with the project during construction, completion, lease-up, marketing, or sale, the developer may seek financial, construction, technical, or other assistance from a stronger partner.

Whether the problems are caused by the developer or by exogenous factors, the stronger partner will typically take a more active role in the project’s day-to-day operations to compensate for his greater financial risk.

Getting along with people who have diverse interests

The owners may have interdependent but different interests in many real estate transactions. It’s relatively uncommon, for example, to come across a joint venture (JV) in which one partner serves as the developer and the other as the general contractor (GC).

It appears to be an excellent synergistic relationship on the surface. However, it might become a serious issue if they have a falling out.

They both want to finish the project in the end, but their immediate concerns prohibit them from doing so. It will be difficult, if not impossible, for the developer to fire the GC if he does not perform as intended.

Suppose the JV includes a partner who is a potential or existing tenant. In that case, you should be transparent about the relationship, including what work is going into the tenant’s space and who is paying for it.

What is a tenant’s recourse if he or she is dissatisfied with the developer’s rate of development or quality of work, and who will suffer the financial penalties? Who will have the upper hand if the JV partners are at odds? Who will be able to seize the initiative?

Of course, you’re attempting to determine the following: Is it good or bad for the project and the lender, given the members and the membership structure? Does it enhance or lessen the lending facility’s risk?

Learn More

Key member’s and Partner’s Roles

The project may confront an undesirable situation in which the developer’s control is endangered, depending on the structure of the borrowing organisation.

As a result, you should be aware of the big investors’ competence, as well as their abilities, strengths, and shortcomings.

This is usually not a difficult assignment because, on most projects, the developer will be the dominant character and the only one you can trust.

Limited partners and cash-contributing members, on the other hand, frequently lack the knowledge, expertise, or inclination to take control of a project unless it has reached a critical stage.

On the other hand, when dealing with larger and more complex negotiations, including multiple layers of the organization or an active JV partner, it may be critical to investigate each member’s function and capacity.

A key member doesn’t need to have substantial development experience.

Even if a large investment bank providing mezzanine financing subordinate to your property development loan does not have direct construction experience, it will have significant financial resources to employ the necessary talents to execute the task.

It should also have sufficient resources and the unquestionable ability to carry your loan in the short term and eventually pay it off with its funds if no refinancing or sale occurs.

Substitute management

The conditions under which other members might vote to remove the developer as managing member and replace him with another member are an essential part of the operating agreement.

Unless your attorney specifies otherwise in the loan document, the developer can be replaced without any approval.

You are missing out if you haven’t yet subscribed to our YouTube channel.

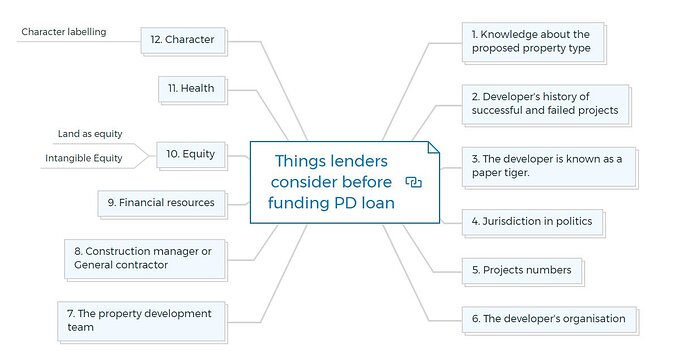

12 Things property development lenders will consider before funding a property development loan

Capacity

Lenders may concentrate on the capacity of the borrowing entity (the participants) once they know its composition. Ability and capacity are said to be equivalent.

They can occasionally reject a property development loan proposal based on the borrower’s capabilities after a brief inspection. Capacity might be a crucial deciding factor.

1. Knowledge about the proposed property type

The developer and development team should have demonstrable experience with the proposed project type. For example, suppose a developer has a construction company that has successfully created freestanding suburban single-family houses.

In that case, he and his company’s experience in developing an urban high-rise office building will be of minimal benefit.

Generally, property lenders never give a developer an “opportunity or a break” to work on a project that isn’t in his area of competence.

If he already has a relationship with you or your institution, try not to be swayed by it or threats that he will take his business elsewhere. You and the institution will probably be better off if the borrower switches lenders.

There are situations, though, when lenders have no choice but to offer a loan to a developer who is not an expert in his field.

When the customer is large enough, the lack of experience in one product category is outweighed by considerable experience in another (for example, a prominent office developer erecting a midsize apartment project).

It can also happen in smaller institutions where political issues trump business. The lenders’ task is to balance the developer’s expertise and experience against the specific project he’s proposing and to change the loan terms to account for any additional risks.

Requesting the developer to expand his team, funding the project in stages if possible, cross-collateralising the loan, obtaining personal guarantees, boosting contingency reserves, and requiring more up-front equity are examples of strategies to accomplish this.

2. Developer’s history of successful and failed projects

If a property development lender realise a developer has failed, he will seek out third parties or ask the developer for an explanation.

A developer may be submitting his first proposal to his institution because he has harmed his connection with another lending institution that views the developer as responsible for poor performance.

Perhaps the borrower did not perform as planned, and the loan’s performance became a significant issue due to the developer. There’s no guarantee that his next deal, which could involve a new investor, will go better.

3. The developer is known as a paper tiger

Some people are better at promoting deals than working them after they close in any business involving salesmanship, marketing, and promotion.

These are frequently, but not always, “big picture” types who produce lovely loan proposals that are more fantasy than reality.

If you get the idea that the developer is exaggerating, too polished, or that the forecasts make the transaction look too good, the lender will verify his résumé of claimed accomplishments carefully, giving special attention to his role, contribution, and engagement in previous projects.

He may have been a part of significant achievements, but only in a small way.

Learn More

4. Jurisdiction in politics

Even small-scale initiatives’ success can be heavily influenced by the political jurisdiction in which they are located. The size, breadth, and character of development can be changed or even killed in urban settings due to a maze of regulations, limits, and politics.

These considerations may be much more critical in suburban and rural locations, where initiatives are more visible and may impact the local population.

A developer working outside his jurisdiction should expect competent, experienced assistance in handling the jurisdiction’s zoning, building, environmental, and other restrictions.

That person can be a local architect in bare instances. Even simple problems can necessitate the involvement of multiple pricey professionals.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

5. Projects numbers

Most middle-market and higher sphere property development firms are dominated by one or a few individuals who play a very active and dictatorial role in their companies.

If the person is working on multiple projects simultaneously, the question is - how many he can work on at once without risking the success of the one being lent against.

If the loan is for a project substantially smaller than the borrower’s other ongoing initiatives, he will most likely devote more time to them.

Because project complexity is not proportional to its size, a new project is more likely to receive insufficient attention.

On the other hand, if your loan is for a large-scale project, the developer’s smaller-scale initiatives may divert his focus, affecting the larger project’s success.

If he takes on too many initiatives at once, not only will his control be diluted, but his time and attention will be diverted as well.

Many seasoned loan officers feel that the money they advance flows straight into the project for which they have lent. In most cases, this is correct.

However, suppose there are cost overruns or delays in a loan advance from another property development lender for a different task. In that case, the borrower may use your provided money to assist his other project.

Essentially, he lends money from a job that is doing well to one that is causing him stress.

Later, if the other project’s finances continue to suffer, he may not be able to continue with the new project.

As a result, the number of concurrent projects and their financial health is critical. It isn’t easy to judge a developer’s capacity to work on multiple projects simultaneously.

An early sense of how busy the developer and his primary staff are and the number of projects he can accomplish will help you decide whether you should be concerned.

Whether he is, he will try to figure out if any of the developer’s projects are having difficulties, which could necessitate more money or attention than usual.

Then the lender must make a judgement call and determine whether the developer and his firm now have the resources to handle the proposed project. If he doesn’t believe they do, ask him to explain how he plans to handle the project, given your worries.

6. The developer’s organization

The structure a developer has developed around his company is related but not directly related to the number of projects he works on at any given time. Lenders look for a strong team of at least one other strong partner who can step in and take his place.

He should also delegate authority (and accountability), especially in areas where subordinates are more knowledgeable. He should have a representative on the job daily in construction, barring unforeseen circumstances.

Learn More

Continued at…

12 Things that property development lenders look for [Part 2-2]