Everything about financing your next investment property

Are you looking to get into property investment but don’t know where to start? Or are you an experienced investor who’s looking for the best way to finance your next purchase?

Whatever your level of experience, this guide will teach you everything you need to know about property investment finance.

It covers all the basics, from mortgages and leasing to borrowing against your existing property. So whether you’re a beginner or a pro, read on for essential information on how to get started in property investment today!

Finance, Finance, Finance

Like Location, Location, Location is true when buying an investment; Finance, Finance, Finance becomes the key factor in moving ahead.

Whether you’re a first-time homebuyer or an experienced investor, whether you’re thinking about plain simple buying, renovating, downsizing, upsizing, looking for a better deal, or consolidating, your ability to move ahead depends on the amount of loan or debt you can get, i.e. your borrowing capacity.

How can you increase that? This is what you are going to learn here.

Is property a good investment? Should I buy an investment property?

Buying an investment property is the best investment you will ever make.

Why so?

Because in most cases, when bought after careful research & due diligence, real estate is the only thing that makes you money while you sleep, especially over a medium to long term. Most investors use property investment as a long-term wealth-generation strategy.

Property Investment gives a solid overall return (which includes both continuous cash-flow income and the capital appreciation of property).

IMPORTANT

Solid Overall Return = Cashflow + Capital Gains

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Pros and cons of investing in real estate

Let’s take a look at the pros and cons and some key concepts of real estate investment, so you can make an informed decision, keeping in mind your borrowing power to turbocharge your investment portfolio.

Pros of property investment

- Property values usually increase over time. If you purchase an investment property and hold onto it for several years, you will likely see a good return on your investment.

- Property is a stable and secure investment. Property prices are not as volatile as stocks and shares and are less likely to plummet overnight.

- Property investment is a great way to build wealth over time. With the right property investment strategies, you can see healthy returns on your investment that can compound over time.

- Although there are always risks associated with any investment, the property is generally considered a low-risk investment.

- Property investment can provide a regular income stream. If you rent out your investment property, it can provide a steady income each month.

Cons of property investment

- Property investment can be expensive. To purchase an investment property, you will likely need a larger down payment than you would for a primary residence.

- Property investment can be time-consuming. If you decide to self-manage your investment property, you will need to be available to show it to potential tenants and deal with any problems that may arise.

- Property investment may not be suitable for everyone. Before investing in property, you should consider your financial situation and your ability to take on additional risks.

- There are no guarantees with property investment. While there are many positive aspects to property investment, there are also no guarantees. Prices can go up or down, and you may not see a return on your investment.

How does equity work when buying an investment property?

When buying an investment property, equity is the amount of cash that the purchaser needs to put forth to cover the gap between the total appraised value of the property and the [loan funding], i.e. total amount borrowed to close the purchase.

Post-purchase, any uplift in the property’s value over time is also accounted for as equity.

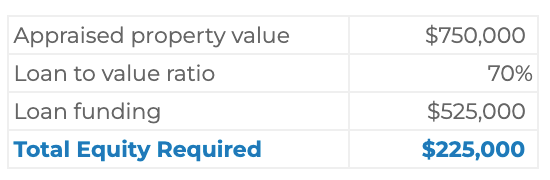

Equity example 1

Total appraised property Value = $750,000

Loan To Value Ratio (LVR) = 70%

Total Loan Funding = $525,000

Equity = Total appraised value of the property x LVR %

Equity = $750,000 - $525,000 = $225,000

IMPORTANT

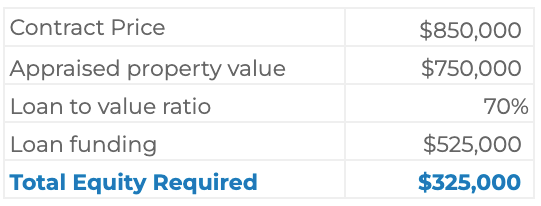

Note that I did not put Total Property Cost, instead I used Total Appraised Property Value.

That’s because you might have signed the purchase contract for $850,000, but if the bank’s valuation says that the property is worth only $750,000, the bank will only loan you a percentage of what the bank valuation determines as the value of the property.

In this case, you will need to add another $100,000 as equity to close the purchase.

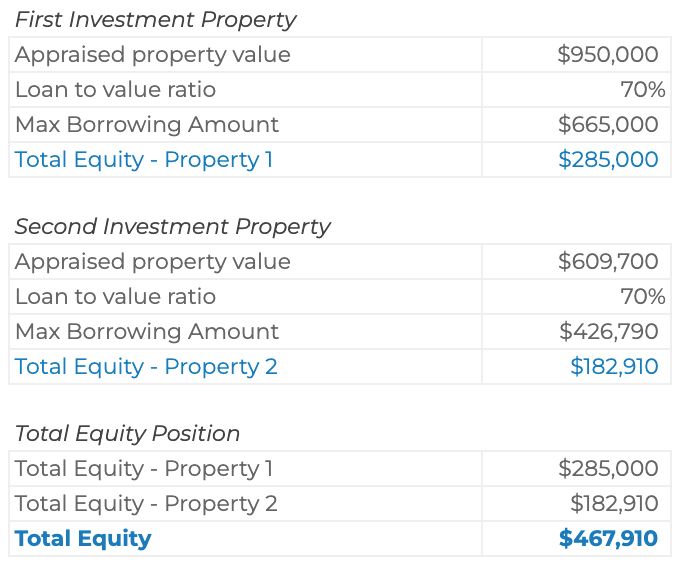

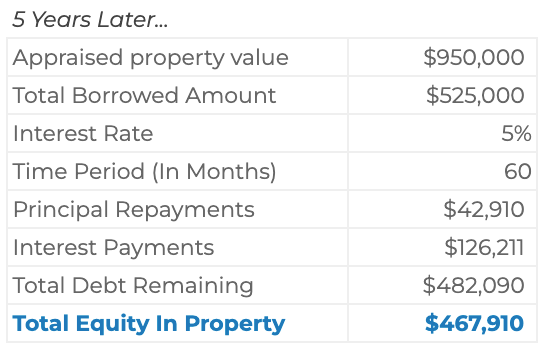

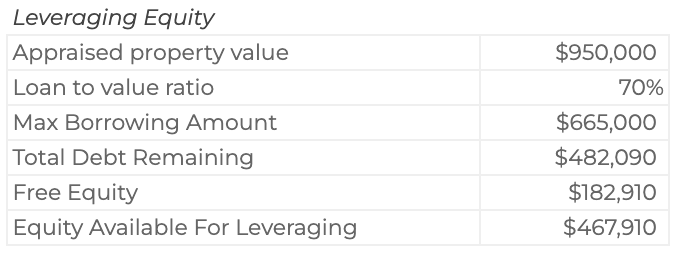

Let’s assume the property market boomed for 5 years, and the property’s appraised value is now $950,000.

You can calculate the total equity in your investment property as…

Total equity = Total Appraised Value - (Total Debt - home loan repayments of principal amount)

5 Years Later…

Appraised property value = $950,000

Total Borrowed Amount = $525,000

Interest Rate = 5% / Annum

Time Period (In Months) = 60

Principal Loan Repayments = $42,910

Interest Payments = $126,211

Total Debt Remaining = $482,090

Total Equity In Property = $467,910

What is LVR in home loans?

LVR stands for loan-to-value ratio aka Loan To Cost (LTC) - A percentage of the total appraised value of the property that the lender is willing to borrow you to complete the purchase.

In other words, it is the ratio of the amount you are borrowing to the property’s appraised value.

In the example above…

- You will need to borrow 70% of $750,000, and your deposit will be 20%, i.e. $225,000

- The higher the LVR, the higher the risk for the lender. It is because there is a greater chance that you will not be able to repay the loan if the value of your property falls.

- Lenders usually charge a higher interest rate for loans with a high LVR.

- Lenders may also require you to take out lenders’ mortgage insurance (LMI) if your LVR is above 80%.

Learn More

How to leverage the equity in an investment property?

The main goal of property investors is to control as much property as possible with as little money of their own by leveraging their equity to borrow to continue to acquire more property responsibly.

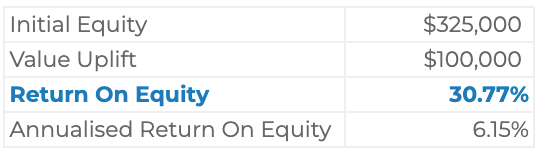

Based on the above example,

Your initial equity was $325,000. Due to a booming property market, your property value (capital gain) soared to $100,000, giving a return on equity of 30.77%, which amounts to an annualised return on equity of 6.15%.

Note:

To keep the calculations simple, I have left out the principal & interest payments made over 5 years and have not accounted for any operating income generated by the investment property and tax deductions claims.

Buying an investment property for the first time

Based on an LVR/LTC of 70%, you can borrow $665,000 against your property. However, your remaining loan balance is only $482,090, which frees up $182,910 of extra equity. As explained earlier, the total home equity in your first investment property is $467,910.

Buying your second investment property

Continuing with 70% as your LVR (loan to value ratio) and your total available equity, you can borrow $1,559,700, using your existing property as collateral.

You already own a property worth $950,000, which leaves $609,700 as the maximum amount you can borrow for your second investment property without injecting any more equity or money to purchase your second investment property.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How to buy an investment property?

Considerations before investing in real estate -

- Figure out if property investment is right for you.

- Are you disciplined?

- Do you have time for research?

- Does property excite you?

- Get rid of any unnecessary debt & limit any wasteful expenses. If you don’t know where to start, simply buy a book on “personal financial advice” and learn to manage your expenses and reduce your debt.

- See your accountant & get financial advice on the right structure for purchasing the investment property.

Before you buy an investment property

- Figure out if property investment is right for you.

- Are you disciplined?

- Do you have time for research?

- Does property excite you?

- Get rid of any unnecessary debt & limit any wasteful expenses. If you don’t know where to start, simply buy a book on “personal financial advice” and learn to manage your expenses and reduce your debt.

- See your accountant & get financial advice on the right structure for purchasing the investment property.

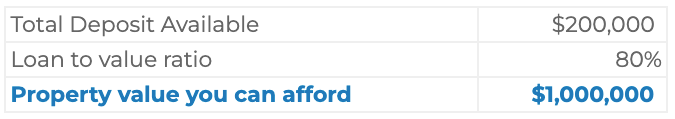

Can I afford an investment property?

Instead of asking yourself how much deposit do I need for an investment property, it is better to determine the total cost of the property that you can afford. Here’s how you can calculate the maximum price of the investment property you can afford.

- Step 1. Determine how much money you have available as a deposit (cash + equity)?

- Let’s say you have $200,000 as free equity and cash.

- Step 2. Call a home lending specialist to determine what percentage lenders borrow against an investment property? Usually, banks can borrow 70%-80% for direct residential investment and sometimes even more with a lender’s mortgage insurance.

- Let’s say you can get a home loan for 80% of the property value.

- Step 3. Now take your deposit money i.e. $200,000 & divide that by 20% (100%-80% LVR)

Voila, the maximum price of the property you can afford is $1,000,000.

This also means that with $200,000 as a deposit, the maximum amount you can borrow is $800,000

- Once you know how much you can borrow, you need to find the right type of loan for your needs. There are many different types of loans available, so make sure to do your research before choosing one.

- Once you’ve found the right loan, you need to negotiate the best interest rate possible. You can do this by shopping around and comparing rates from different lenders.

When comparing investment property mortgage rates, there are a few things you need to consider.

- Interest rate - You want to find a loan with the lowest interest rate possible. Make sure you check the comparison rate for each type of loan side by side.

- Term of the loan - You want to find a loan that has a term that suits your needs.

- The repayment schedule - You want to find a loan that you can afford to repay without putting too much strain on your finances.

- Finally, once you have the loan in place, you need to keep up with your repayments. Missing a repayment can negatively impact your credit score, so staying on top of things is essential.

How to increase home loan borrowing capacity?

Here are the top 9 ways to increase your borrowing capacity

- Improve your credit score & keep an eye on it. It will increase your chances of obtaining a loan. Keeping an eye on your credit score will ensure that you keep your credit history clean.

- Earn more, get a second job, do property development on the side. This will free up funds for a loan and generate the equity you need to use as a deposit.

- Reduce your other miscellaneous debts, like car loans, bridging loans, etc., and reduce your credit card limit. This will allow you to borrow more money.

- Apply with a lender that offers investor-friendly financing conditions. For example, amortize the loan over 30 years rather than 25 years. The longer the amortization period, the lower your monthly repayments.

- Split debt by applying for loans with your spouse so that you can use your combined income to service the loan.

- Purchase investment properties that are cash-flow positive.

- Reduce your cash outflow, i.e. your monthly expenses. These days, lenders even check your total number of subscriptions for streaming services like Netflix, Disney+, etc. Each monthly subscription shaves off your borrowing capacity.

- Avoid family pledges or being a guarantor.

- Apply for a loan when you’ve been at your employment for more than six months

IMPORTANT

What is Lenders Mortgage Insurance?

Lenders Mortgage Insurance (LMI) is insurance that’s paid by the borrower but covers the lender in case the borrower defaults on their payments and the property (collateral) is sold for less than the total debt on the property.

Lenders’ Mortgage Insurance (LMI) is required if you’re borrowing more than 80% of the property’s value. LMI protects the lender if you default on your mortgage repayments and they need to sell the property.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

Continued at…

The Ultimate Guide To Property Investment Finance [Part 2-4]

The Ultimate Guide To Property Investment Finance [Part 3-4]

The Ultimate Guide To Property Investment Finance [Part 4-4]